Market Overview

“Market data both in spot and derivatives shows that further upside is the most probable outcome, however, we are cautious given that BTC has sold off following past seminal moments...” These were our last words in our October Market Overview. Since then, the Bitcoin price had a sharp rise to 69k (ATH) and fell afterwards to 53.5k (-22.5%).

The fall in crypto markets (as well as in traditional markets) was accelerated by automated liquidations on top of an over leveraged crypto space and further news from a new COVID variation. Inflation and tapering news are not helping on a macro level but we don't consider them to be the triggers of this -20% drawdown.

Implied volatility hasn't expanded as we would have expected; more so, it has moved sideways between 75% and 80%. Skewness favoured Put options, but it hasn't overreacted either, which shows uncertainty towards entering into a bearish market scenario.

Facing growing inflation, US debt-ceiling discussions and Omicron variant, December is likely to have a sharp re-pricing of the assets and high levels of volatility.

Performance

During the -20% drawdown we maintained adequate levels of cash which we used to restructure new option products. Contango premium was collected and a good return came from the LPs allocation.

Looking forward, we will increase our capital in our option structured products which have done very well during the last couple of months.

Teks Alpha Performance (%)

| JAN | FEB | MAR | APR | MAY | JUN | JUL | AUG | SEP | OCT | NOV | DEC | YTD | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2021 | — | — | 1.36 | 0.79 | 0.77 | 0.80 | 1.51 | 1.61 | 1.15 | 2.56 | 1.70 | — | 12.9 |

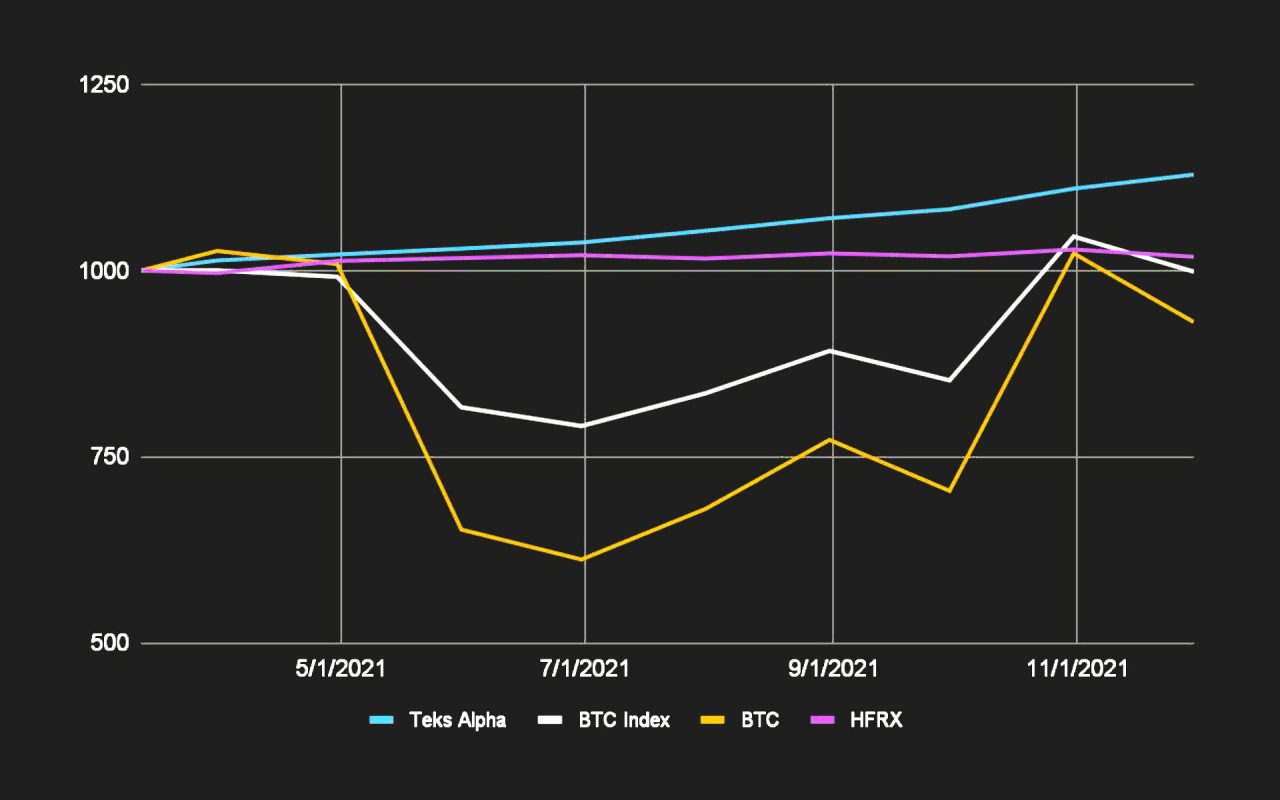

Teks Alpha Performance vs Index

Given the nature of Teks Alpha we have chosen as a Benchmark an Index composed 50% by BTC and 50% by cash.

Given the nature of Teks Alpha we have chosen as a Benchmark an Index composed 50% by BTC and 50% by cash.