Market Overview

During August, a positive market sentiment returned and the crash of May where BTC went down almost -55% is further in the rearview mirror. An astonishing, but very “crypto-style” recovery took place with BTC prices going back to the $50k level (+80% reversion) by August 23. Altcoins and lesser-known tokens had also outperformed and boosted the crypto excitement like LUNA (Terra), FTM, and AVAX, among others.

There is little consensus as to what's pushing the market, some investors are looking to gain more than the mainstays cryptos by exposing their portfolio’s into a higher Beta; others are just seeing a world full of cash which tends to be allocated in riskier assets (specially under bullish markets and soaring prices).

Crypto market capitalization is above $2 trillion dollars again and bullish traders seem to be buying on every pullback and downtick. Spreads between future\spot prices are low meaning that leverage is not uncontrolled while volatility has been falling and affecting option premiums.

Performance

During August we kept trading a combination of derivatives and structured-product strategies increasing our allocation into market-neutral combinations.

We will keep shorting vols whenever we see attractive opportunities and we will keep our research for adding positive deltas with minimum downside risks.

Teks Alpha Performance (%)

| JAN | FEB | MAR | APR | MAY | JUN | JUL | AUG | SEP | OCT | NOV | DEC | YTD | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2021 | — | — | 1.36 | 0.79 | 0.77 | 0.80 | 1.51 | 1.61 | — | — | — | — | 7.03 |

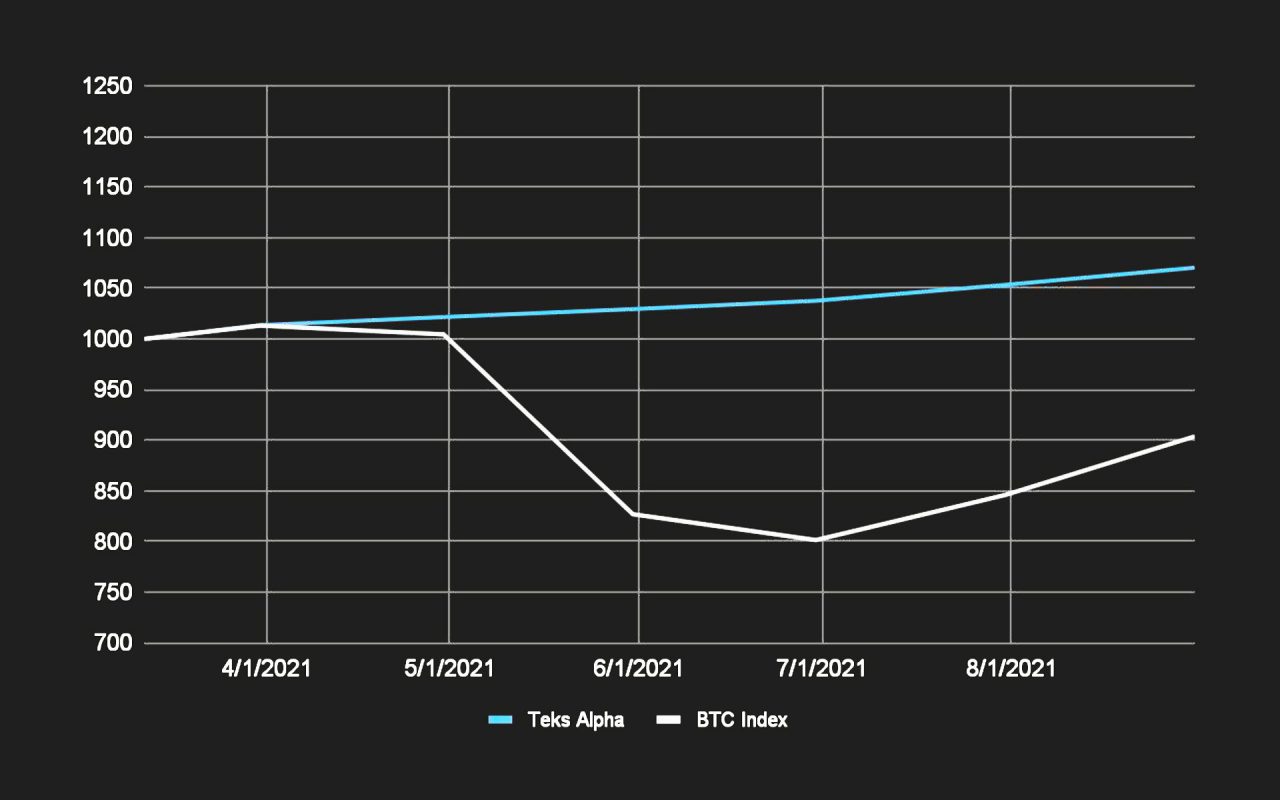

Teks Alpha Performance vs Index

Given the nature of Teks Alpha we have chosen as a Benchmark an Index composed 50% by BTC and 50% by cash.

Given the nature of Teks Alpha we have chosen as a Benchmark an Index composed 50% by BTC and 50% by cash.