Market Overview

September was again a negative and a highly volatile month for both traditional and digital assets. BTC returned -3.16%, its sixth negative September (in line with its negative seasonality), and ETH was down -14.5%. The BTC price had intra-month variations of +/-7% more than twice.

In the case of traditional assets September was the worst month in two decades for the S&P. Amid continued economic uncertainty and macro risks, both the S&P and the Nasdaq ended in negative territory for the third quarter in a row, something that did not happen since 2008. The current problems now include the Bank of England buying 65b pounds of securities, rumors of Italy in trouble as since January the spread of the Italian 10 year bond over the German Bund has doubled to 2.4% which might bring in the ECB to purchase bonds, also gossip about a major global bank with certain liquidity problems, plus the apparent sabotage to the Nord Stream pipelines.

The S&P ended -8.71% for the month and the Nasdaq -10.7%. US Bonds (safe haven) and Gold were both down, -6.75% and -3.13%, respectively.

As we had expressed in our prior newsletter, September is historically the worst month for BTC and now we can extend the concept to every “risky” asset.

Performance

During September, the Fund was almost flat returning -0.5%.

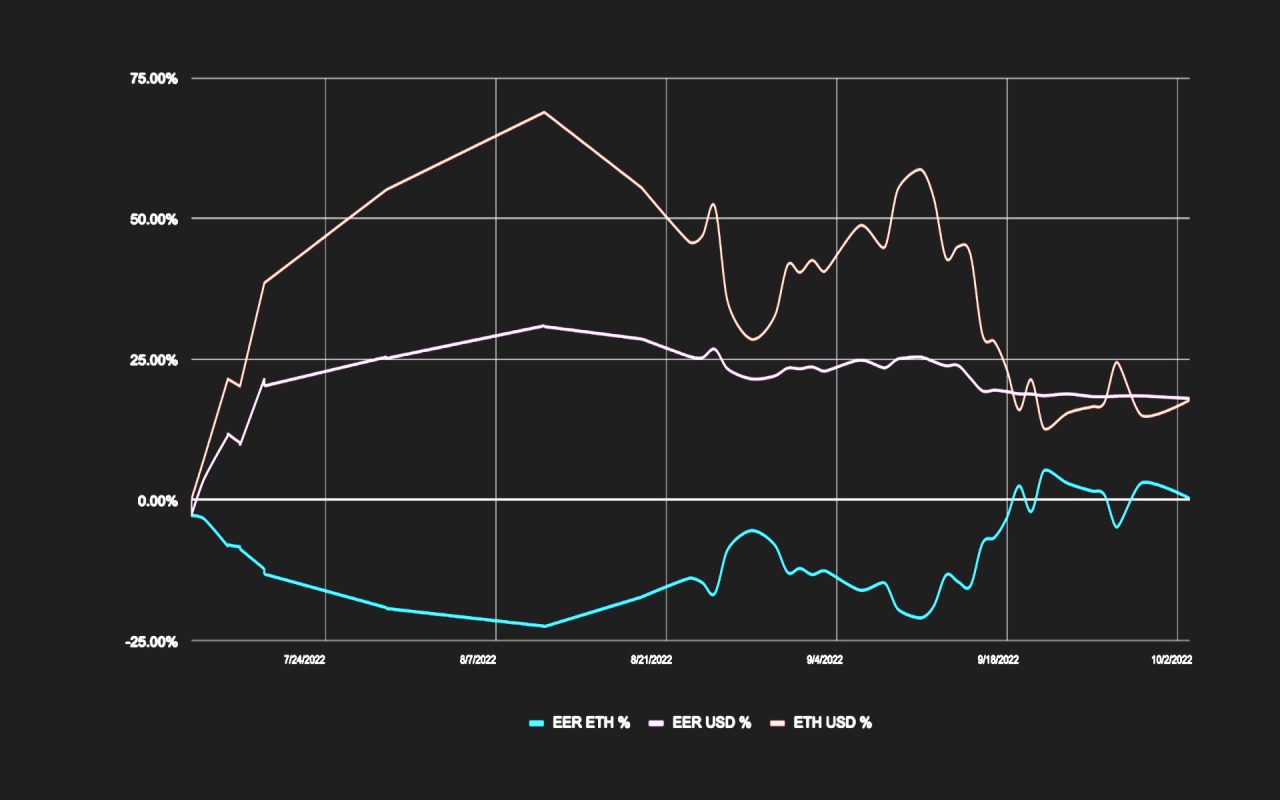

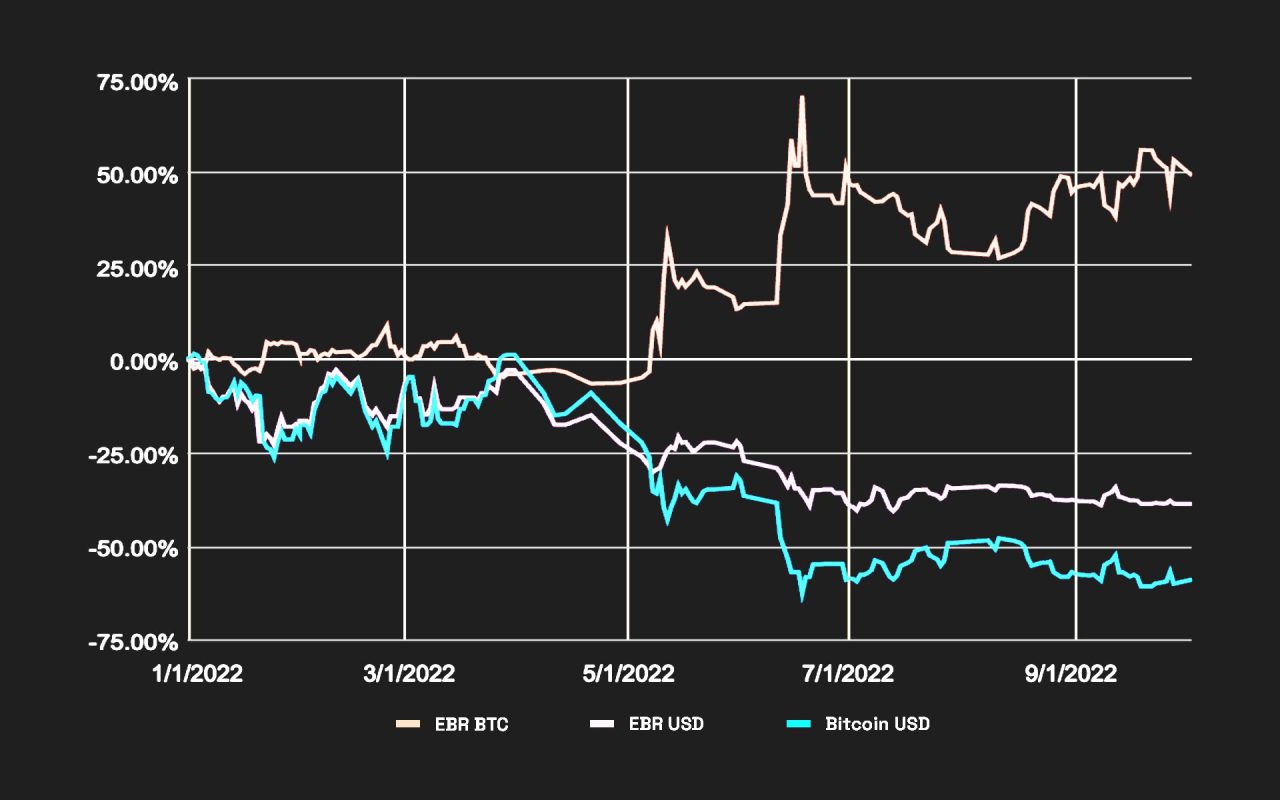

Our short vegas were able to capture good premiums, but the long deltas in our portfolio affected the overall USD return, especially our long ETH structured position. We believe in the upside potential of ETH, thus, through our Enhanced Digital products (developed for both BTC and ETH and part of Teks Alpha), we had an ETH profit of 12% and reduced the ETH/USD loss to -4.2% (versus the -14.5% ETH return). With our BTC long delta structured product, we were able to increase the BTC position by 2.76% minimizing the BTC/USD loss to -1.75% (compared to BTC -3.1%).

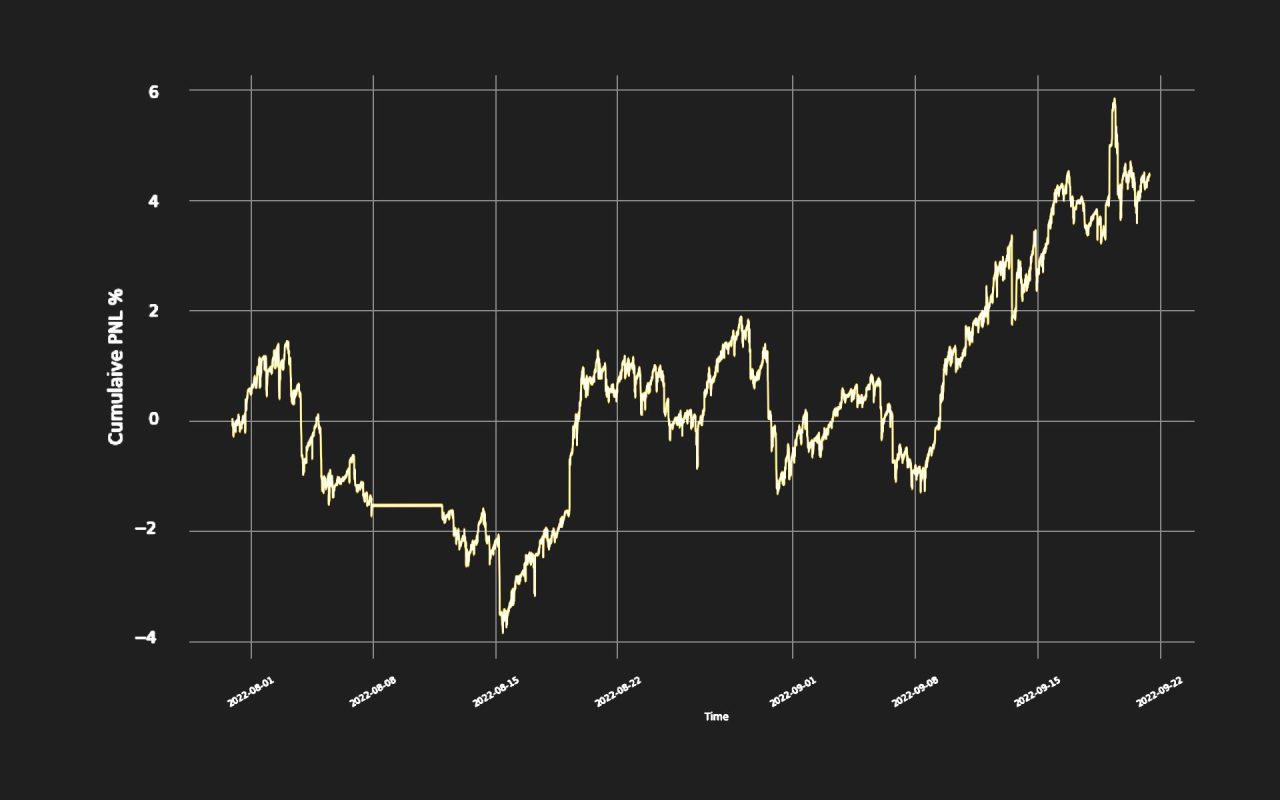

Our pure quant strategy, Teks Trend, keeps generating a monthly Sharpe above 2.5 so we are steadily incrementing the size of the investment.

Our pure quant strategy, Teks Trend, keeps generating a monthly Sharpe above 2.5 so we are steadily incrementing the size of the investment.

EBR (Enhanced BTC Return)

Cumulative PNL %

Outlook

Looking forward, we are still expecting volatile months ahead. Even if October is traditionally a positive month (posting gains in the past 7 years out of 9), given the above mentioned macro issues news we are going to be extra cautious in adding long exposure on top of our current positions.

Finally, from a technical point of view, we are seeing large volumes in the open interest downside risk hedges on risk assets, which is another evidence of a negative market sentiment (however, it is worth pointing out that is a contrarian indicator).