Market Overview

October, known in jargon as “Uptober”, has marked +45% which is the highest BTC monthly return since December 2020. Despite the market softening at the end of the month, price has consolidated around $60k.

The excitement was motivated by the launch of the futures BTC ETF ($BITO), surpassing $1.1B in assets under management in the first two days of trading and outpacing an 18-yr record set by the $GLD Gold ETF. Ethereum has actually made a new all-time high too, eclipsing the previous HWM of $4.3k set on May 12.

Market data both in spot and derivatives shows that further upside is the most probable outcome, however, we are cautious given that BTC has sold off following past seminal moments, including the listing of BTC futures on the CME in December 2017 and the listing of Coinbase Global Inc. on Nasdaq in April this year.

Performance

Back to basics, we have taken advantage of the increment in the funding rates from perpetual swaps and contangos from the futures curve, which were driven by to the market's optimism and euphoria. Additional cash-short-vegas were captured too, which led us to have our best month since we launched the Cell.

Looking forward, we will continue in line with this positions and we will add hedged LPs seeking to capture higher returns without incurring in direction risk.

Teks Alpha Performance (%)

| JAN | FEB | MAR | APR | MAY | JUN | JUL | AUG | SEP | OCT | NOV | DEC | YTD | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2021 | — | — | 1.36 | 0.79 | 0.77 | 0.80 | 1.51 | 1.61 | 1.15 | 2.56 | — | — | 11.01 |

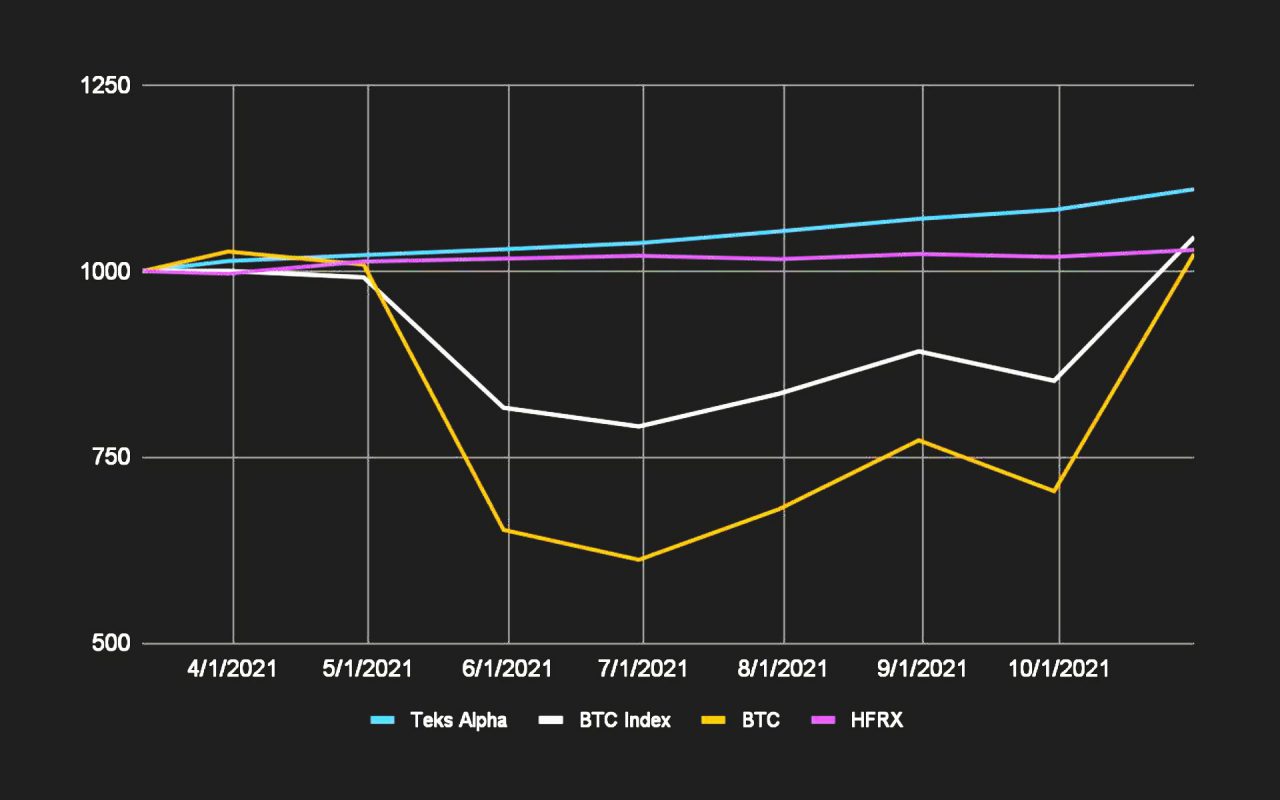

Teks Alpha Performance vs Index

Given the nature of Teks Alpha we have chosen as a Benchmark an Index composed 50% by BTC and 50% by cash.

Given the nature of Teks Alpha we have chosen as a Benchmark an Index composed 50% by BTC and 50% by cash.