Market Overview

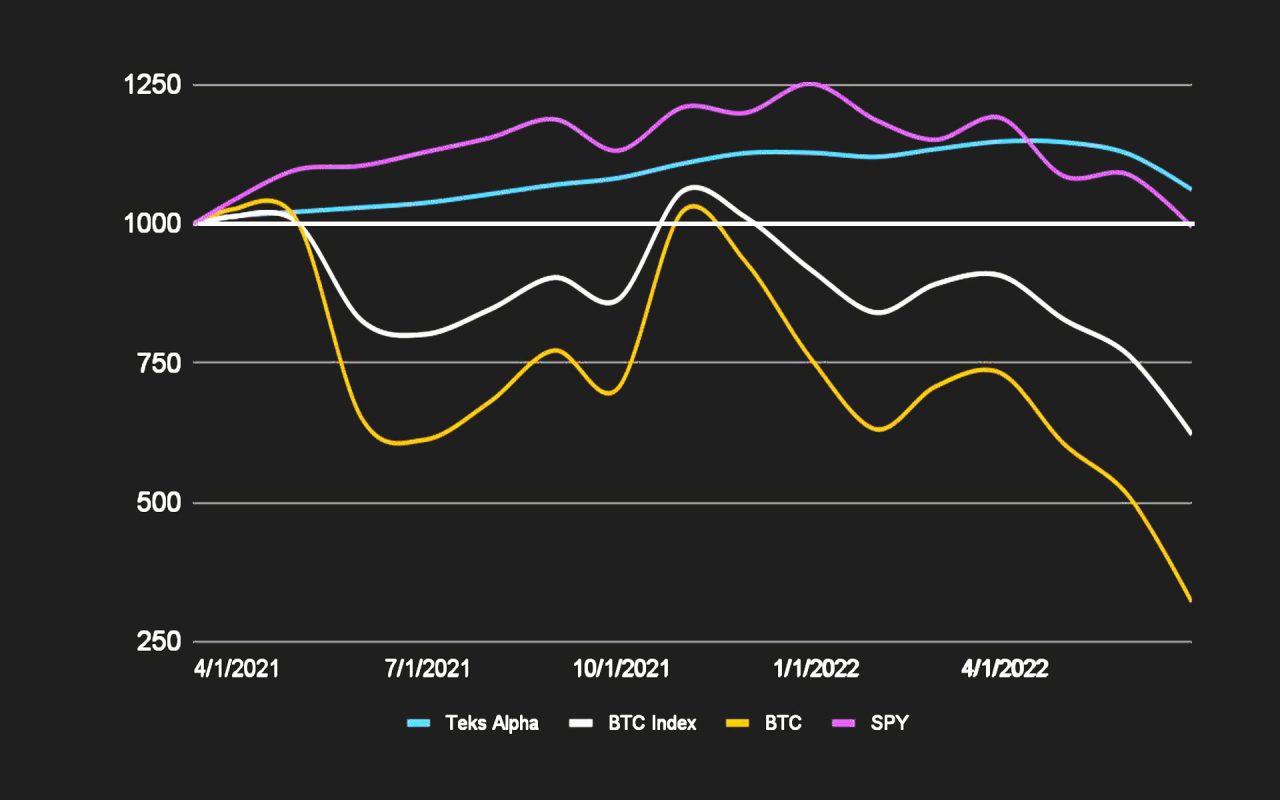

June was another extremely difficult month for both traditional and crypto assets. BTC crashed over -37.3%, the biggest monthly price drop since 2011 while the DeFi space had a total decrease on its TVL of 70% and a price drop (as per the DeFi Perp) of -31%. The current BTC drawdown from it’s all-time-high in mid November 2021 is 72%. Several factors contributed to this severe meltdown. One was the consequences of 3AC’s insolvency accelerated by the previous collapse of the Terra ecosystem (in which they were large investors). This brought a contagion to the asset class as a whole. Digital asset lending and borrowing companies were put in a very difficult situation and companies such as Celsius, Coinflex, etc. had to freeze withdrawals generating an increasing market FUD. Many others are also in trouble given unsustainable yields offered to clients. Larger exchanges are laying off around 20%+ of their workforce. Teks Capital has not exposed its managed Fund (Systema) to any crypto credit (or related) business. This protected Systema’s assets from irreversible losses while reinforcing the Fund as a safe vehicle for any investor willing to gain digital asset exposure and capture alpha under a professionally managed and regulated asset management company. The risks were very clear, although many chose to ignore them. At Teks we take risks management very seriously and therefore were not affected by this lack of analysis. The S&P ended up -8.4% for the month and the Nasdaq fell -8.8% with an intra month max drawdown of -12% and -13%, respectively. Not even US Bonds (safe haven) were profitable, they were down -1.4% and Gold -1.5%. Since Teks Alpha’s inception in mid March 2021, BTC is down -67%, ETH performed -42%, Nasdaq is down -12.5%, the S&P is down almost -5%, and US Bonds are down -12.5%. Only Gold is up 5%. In comparison, Teks Alpha has achieved a total return since inception of +6.2% net of fees, with a max volatility of 6.6% and max drawdown (currently) of -7.5% overcoming one of the most difficult market conditions with some negative characteristics not even seen during the crisis of 2008-2009. Volatility with large up/down price movements will continue as long as the macro remains fragile: FED rates hike, FED QT, China COVID restrictions and an endless Ukraine-Russia war.Performance

During the month of June, the Fund returned -5.7%. As expressed above, we are comfortable with our relative performance and risk management in an extremely difficult market. As expressed in our prior newsletter, we have been preparing the fund to execute strategies to capture upside when the market turns around, while at the same time protecting the downside through structured products. Our trading team is actively trading and refining its quant models; some of them have generated returns in BTC of +33% during June. Hence, Teks Trend, a pure quant sub-strategy, will be launched during the first week of July after preliminary testing of more than 65k trades and a Sharpe Ratio of almost 2.5 since 2019.Teks Alpha Performance (%)

| JAN | FEB | MAR | APR | MAY | JUN | JUL | AUG | SEP | OCT | NOV | DEC | YTD | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2021 | — | — | 1.36 | 0.79 | 0.77 | 0.80 | 1.51 | 1.61 | 1.15 | 2.56 | 1.70 | — | 12.9 |

| 2022 | -0.65 | 1.20 | 1.05 | -0.10 | -1.85 | -5.7 | — | — | — | — | — | — | -5.8 |

Teks Alpha Performance vs Benchmarks since inception (March 2021)

| TEKS A | BTC | BTC IND | HFRX | |

|---|---|---|---|---|

| Effective | 6.15% | -67.95% | -37.83% | -0.54% |

| Annualized | 4.73% | -52.22% | -29.07% | -0.41% |

| STD Dev | 6.66% | 70.20% | 35.10% | 16.84% |

| Shape Ratio | 0.33 | -0.78 | -0.90 | -0.17 |

Benchmarks: BTC Index is an index composed 50% by BTC and 50% by cash. BTC price index is conformed by the Bitstamp price of BTC at 18 CEST. The HFRX Global Hedge Fund Index is designed to be representative of the overall composition of the hedge fund universe. It is comprised of all eligible hedge fund strategies; including but not limited to convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry.

Benchmarks: BTC Index is an index composed 50% by BTC and 50% by cash. BTC price index is conformed by the Bitstamp price of BTC at 18 CEST. The HFRX Global Hedge Fund Index is designed to be representative of the overall composition of the hedge fund universe. It is comprised of all eligible hedge fund strategies; including but not limited to convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry.