Market Overview

June has been a month where investors have experienced rollercoaster prices in the cryptomarket. The period started with Bitcoin trading at breakdown levels and climbing by mid June after hedge fund managers publicly supported cryptocurrencies and Tesla ́s CEO confirmation that the company would resume transactions in BTC if crypto mining facilities utilize green energy.

At month end, downside pressure was brought back by China ́s crypto clampdown and on June 22, BTC hit $28.8k and was briefly taken into negative territory for the year.

Although the price rebounce, the coin is down ~50% from its mid-April high and BTC bullish fundamentals are not strong with multiple level of resistances in the 40s and 50s. Exuberant rallies and quick drawdowns are not uncommon for BTC and cryptocurrencies.

Finally, we expect choppy months ahead with price volatility soaring subject to increased regulations and macroeconomic conditions led by the fed’s tapering its asset purchases.

Performance

During June we switched from futures to options strategies taking advantage of the IV spike as a result of the choppy waters. We also started with LPs in the DeFi space generating an extra rate on top of our stable currencies.

Looking forward, we are going to continue selling collateralized low-delta options and we are going to initiate a structure product combining options with LPs.

Teks Alpha Performance (%)

| JAN | FEB | MAR | APR | MAY | JUN | JUL | AUG | SEP | OCT | NOV | DEC | YTD | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2021 | — | — | 1.36 | 0.79 | 0.77 | 0.80 | — | — | — | — | — | — | 3.80 |

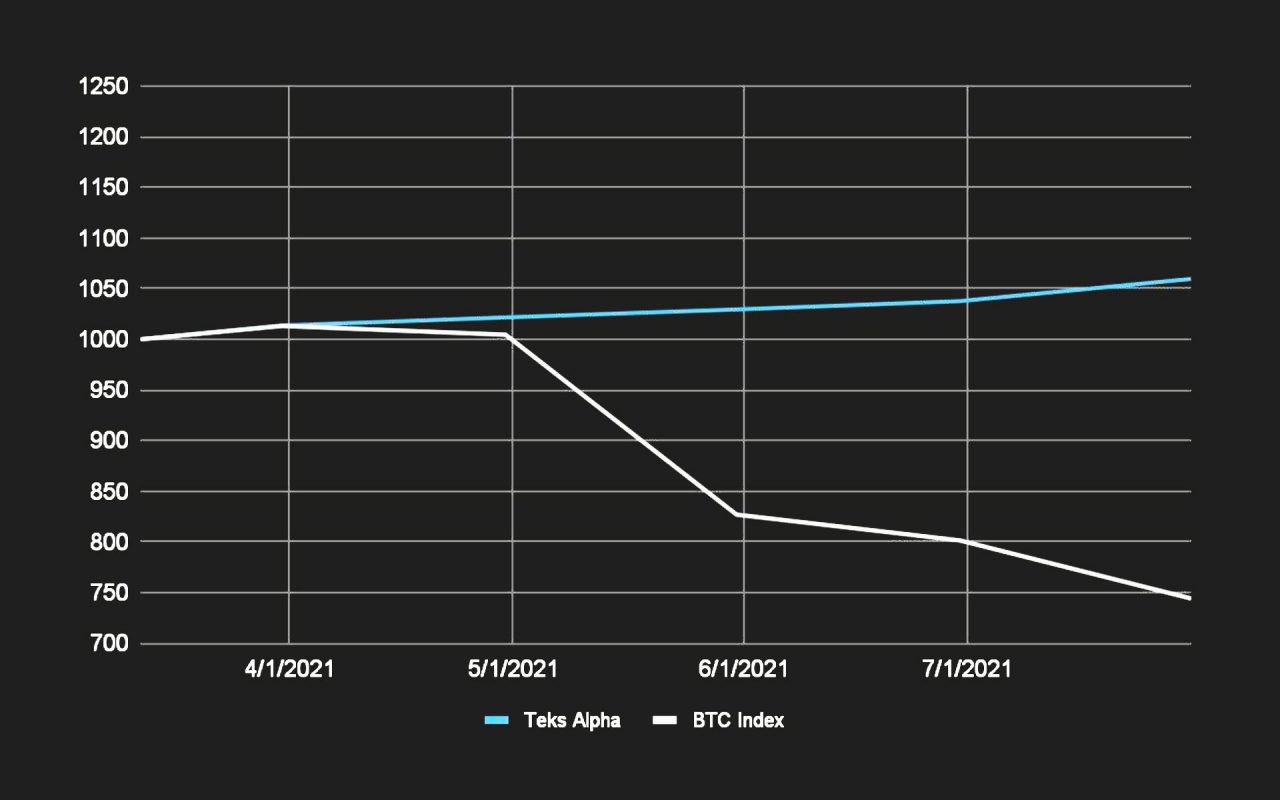

Teks Alpha Performance vs Index

Given the nature of Teks Alpha we have chosen as a Benchmark an Index composed 50% by BTC and 50% by cash.

Given the nature of Teks Alpha we have chosen as a Benchmark an Index composed 50% by BTC and 50% by cash.