Market Overview

During July, the bitcoin market has experienced wild price swings with a true range value (difference between the highest and lowest price of a given period of time) of almost 45%.

BTC dropped -15.3% by the first half and bounced +40% during the last 10 days of the month. The fall in the price of BTC that wiped out almost $1.3tn dollars was driven by the FED rumors towards speeding up its tapering plan (specially after inflation numbers spiking higher than expected) and speculations regarding central banks exploring the usage of digital currencies outside the scope of bitcoin. During the second half of the month, specially after the “B Word” conference and speculations regarding Amazon vacancy for a digital currency product lead, the price strongly recovered spiking ~40% from mid-month lows.

Implied volatility both for bitcoin and ethereum has been relatively low reaching levels that were last seen in May 2021. Downside fear was short-lived with front-end vols spiking by mid July and normalizing (normalized vol-curve) together with btc ́s price rally by the end of the month.

Performance

During the month we traded a combination of derivatives and structured products strategies.

Looking forward, we believe that BTC price will have strong fluctuations between a 30% price range (unless more news like Amazon ́s headline show up). We will increase our focus in the structured products to be able to gain delta exposure with very limited downside risk.

Teks Alpha Performance (%)

| JAN | FEB | MAR | APR | MAY | JUN | JUL | AUG | SEP | OCT | NOV | DEC | YTD | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2021 | — | — | 1.36 | 0.79 | 0.77 | 0.80 | 1.66 | — | — | — | — | — | 5.49 |

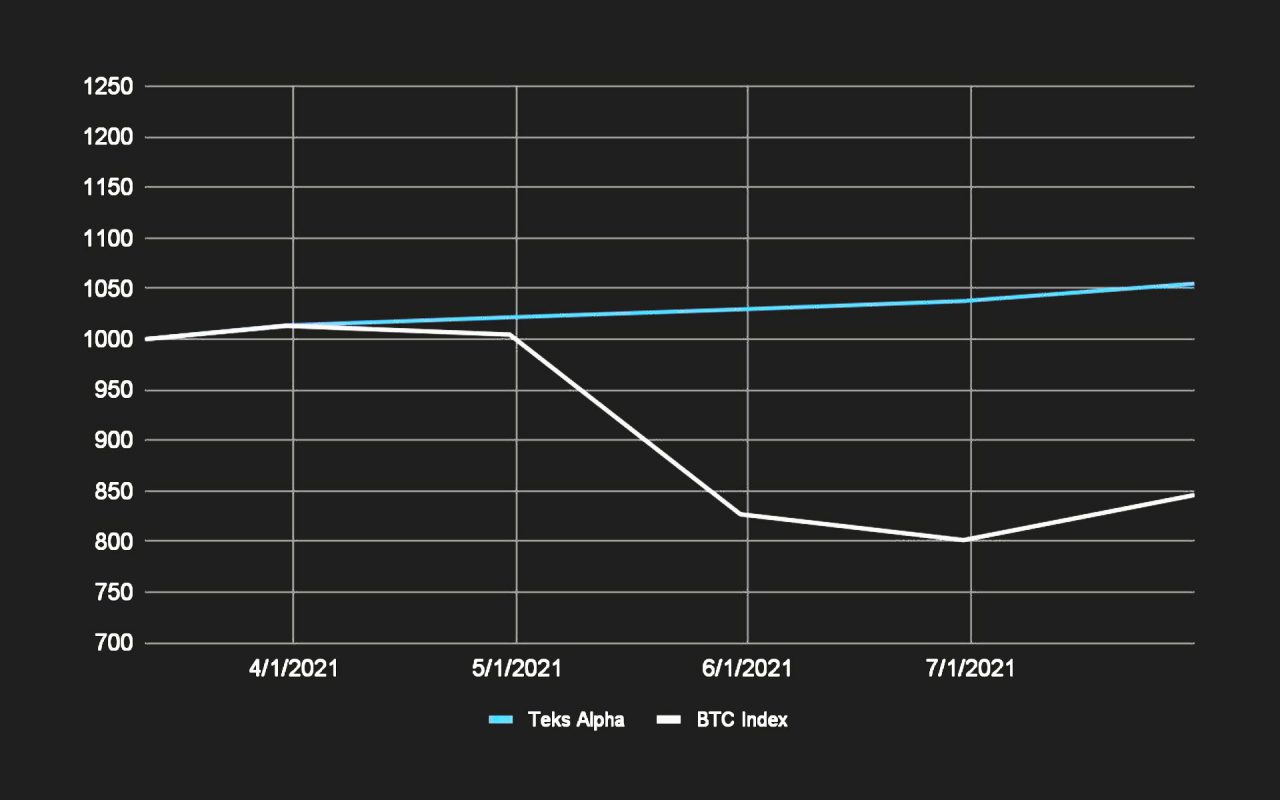

Teks Alpha Performance vs Index

Given the nature of Teks Alpha we have chosen as a Benchmark an Index composed 50% by BTC and 50% by cash.

Given the nature of Teks Alpha we have chosen as a Benchmark an Index composed 50% by BTC and 50% by cash.