Market Overview

May was another extremely difficult month for both traditional and crypto assets.

In the case of traditional assets, the S&P ended up flat for the month, but was down almost -8% by May 20th. On the other hand, the Nasdaq fell -1.6% with an intra month max drawdown of -10.5%. YTD the S&P is down -13% and the Nasdaq is down almost -23%. In this uncertain environment full of macroeconomic and geopolitical risks, not even US Bonds are acting as a safe haven; they are down -13.6% YTD. Gold was also down -3% in May while showing a marginally return of +1.7% in 2022.

The main issue and the uncertainty going forward is how much the rise in interest rates will slow down the economy plus the lack of clarity towards quantitative tightening (QT) actions by the FED. There is no doubt that the Fed will raise interest rates several times to control inflation which is already reducing profit margins by increasing companies’ costs and narrowing the PV of future cash flows. This hike in rates has affected stock prices especially those from low-revenues (if not nonexistent-revenues) companies: such as “high tech” “bio tech” and of course crypto assets.

BTC has traded down almost non-stop to below 25.5K -an intra-month drop of -34%- falling for 10 consecutive weeks! (a historical record) . At the end of the month (basically the last 2 days), we finally saw a rebound triggered by China loosening its lockdown restrictions on major cities. The month ended with BTC down around -16%, ETH down -28% and the DeFi sector (DEFI Perp) -35%. At these levels, BTC and ETH are down almost 60% since last November and YTD are -35% and -50%, respectively . We continue to expect volatility ahead as liquidity remains low.

The major bad news in the crypto space was the collapse of the TERRA ecosystem during the second week of May. Over the course of just a few days Terra ́s main tokens LUNA/UST (which were part of the top 10 crypto market cap) erased almost $40bn in investor value. This wiped out around 500 Billion of market capitalization in digital assets and raised concerns and panic in the markets.

At the Fund, we only had a minor exposure to LUNA and have taken a hit of -0.8% in the month due to a structured option trade.

Performance

During the month of May, the Fund returned -1.8%. We are very happy about our relative performance in an extremely difficult market.

Also we have been preparing the fund to execute strategies to capture upside when the market turns around, while at the same time protecting the downside through structured products.

In summary, our long delta positions suffered in the month, but we made outstanding returns with our Bitstone strategy (option-based long BTC strategy with downside protection) of almost +10% in USD and +30% in BTC. Our trading team is actively refining its quant models, including Bitstone, to outperform markets (both crypto and traditional) and continue to provide outstanding returns.

Teks Alpha Performance (%)

| JAN | FEB | MAR | APR | MAY | JUN | JUL | AUG | SEP | OCT | NOV | DEC | YTD | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2021 | — | — | 1.36 | 0.79 | 0.77 | 0.80 | 1.51 | 1.61 | 1.15 | 2.56 | 1.70 | — | 12.9 |

| 2022 | -0.65 | 1.20 | 1.05 | -0.10 | -1.85 | — | — | — | — | — | — | — | -0.3 |

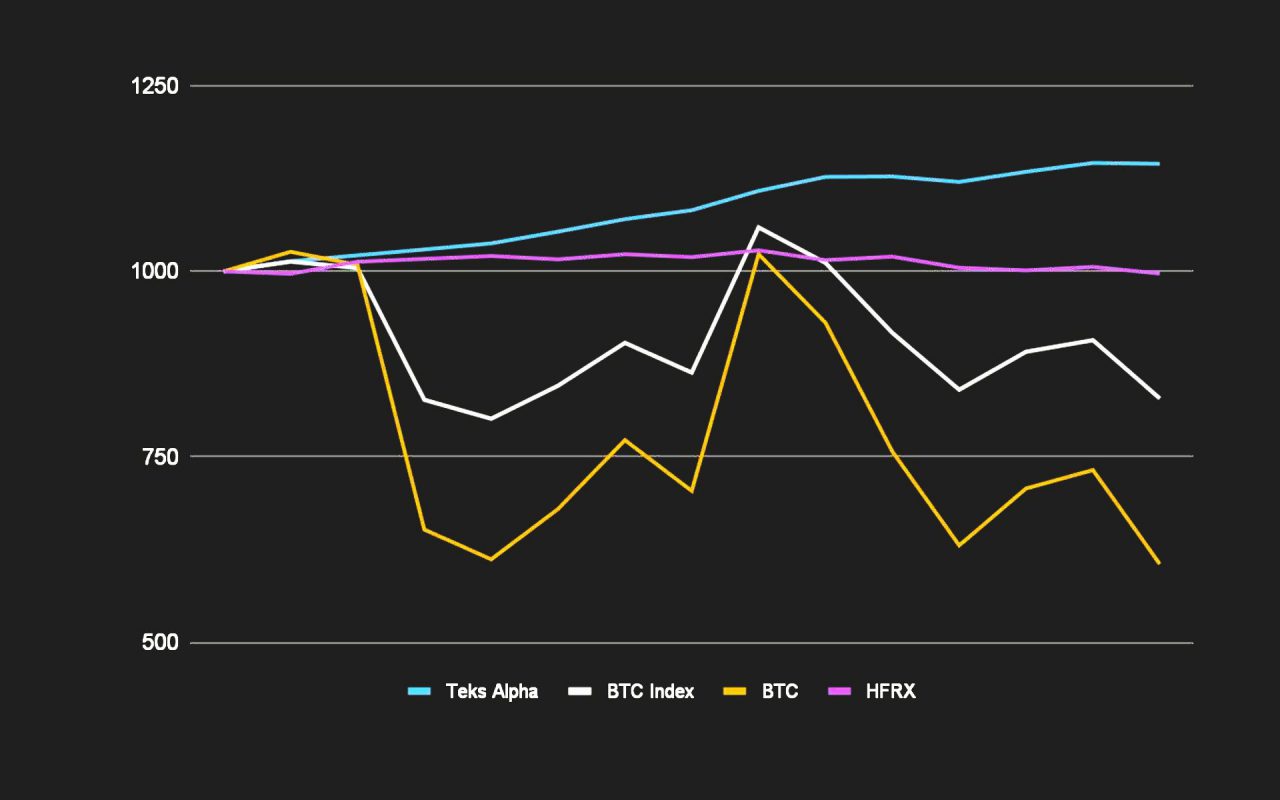

Teks Alpha Performance vs Benchmarks since inception (March 2021)

| TEKS A | BTC | BTC IND | HFRX | |

|---|---|---|---|---|

| Effective | 12.38% | -48.91% | -23.60% | -1.39% |

| Annualized | 10.15% | -40.12% | -19.35% | -1.14% |

| STD Dev | 3.67% | 65.74% | 32.87% | 3.06% |

| Shape Ratio | 2.09 | -0.65 | -0.66 | -1.19 |

Benchmarks: BTC Index is an index composed 50% by BTC and 50% by cash. BTC price index is conformed by the Bitstamp price of BTC at 18 CEST. The HFRX Global Hedge Fund Index is designed to be representative of the overall composition of the hedge fund universe. It is comprised of all eligible hedge fund strategies; including but not limited to convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry.

Benchmarks: BTC Index is an index composed 50% by BTC and 50% by cash. BTC price index is conformed by the Bitstamp price of BTC at 18 CEST. The HFRX Global Hedge Fund Index is designed to be representative of the overall composition of the hedge fund universe. It is comprised of all eligible hedge fund strategies; including but not limited to convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry.